do nonprofits issue 1099s|1099s : Tuguegarao You’ll know that you’ll need to issue a form 1099 when the following four conditions are met: You made a payment to someone who is not your employee. You made a payment . Pull off of NH 169A and settle into your spacious room or suite at the Country Inn & Suites by Radisson, Manipal in Udupi. Our hotel’s ideal location puts you within walking distance of Manipal University and several of its campuses.

PH0 · What Are the Nonprofit 1099 Rules?

PH1 · Understanding 1099 For Non

PH2 · Information returns (Forms 1099)

PH3 · Form 1099 for Nonprofits: How and Why to Issue One

PH4 · Form 1099 for Nonprofits: How and Why to Issue One

PH5 · Do Nonprofits or Churches Need to Complete 1099s?

PH6 · Do Nonprofits Need to Issue 1099s?

PH7 · 1099s

PH8 · 1099 Best Practices for Your Nonprofit

Mostbet India has an exceptional bonus program with prizes and rewards for every active client. Let’s learn the main offers of the bookie. First deposit bonus of 125% up to ₹34,000. Kick off your journey .

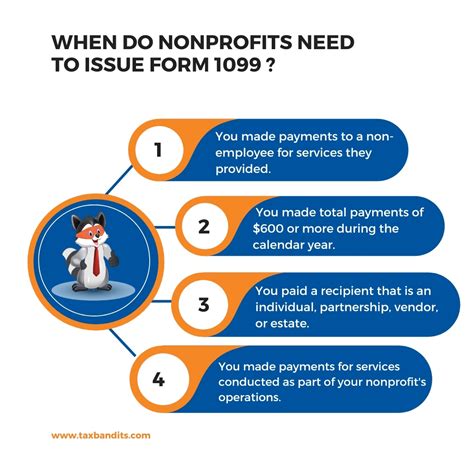

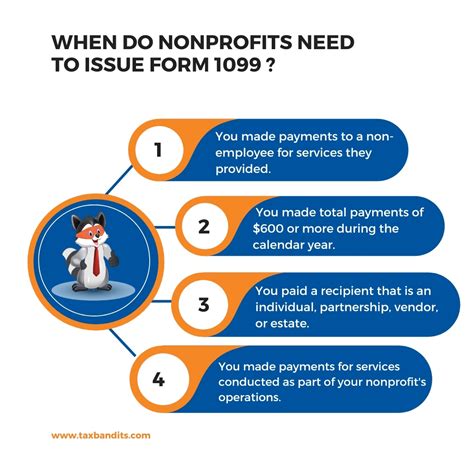

do nonprofits issue 1099s*******While a nonprofit has different accounting rules and tax requirements than a for-profit business, some laws apply to both. A nonprofit also has to issue Form 1099s under certain circumstances – generally, when a non-employee or independent contractor .When do Nonprofits Need to Issue Form 1099? Nonprofits should issue Form 1099 when they pay $600 or more in a year to non-employees for services rendered. This .You’ll know that you’ll need to issue a form 1099 when the following four conditions are met: You made a payment to someone who is not your employee. You made a payment .Information returns (Forms 1099) A tax-exempt organization must file required information returns, such as Form 1099-MISC PDF. An organization does not withhold income tax or .by Alan Sembera. Published on 1 Jan 2021. A nonprofit organization has the same responsibility as a business when it comes to issuing 1099 information forms. For .

Do Nonprofits or Churches Need to Complete 1099s? written by Aplos Success Team. Any organization that meets the filing requirements is required to complete 1099s, .- MoneyMinder. Treasurer How-To's. What Are the Nonprofit 1099 Rules? Cyndi Meuchel January 6, 2021. Many times, nonprofits have small budgets and the work at hand can .When do nonprofits need to issue 1099 forms? You’ll need to issue a form 1099 if the following 4 conditions are met: You made a payment to someone who is not your .do nonprofits issue 1099sA Form 1099 is the miscellaneous income tax form, used to prepare and file income information that is separate from wages, salaries, or tips. For nonprofits, you must .Why are 1099 Forms Important for Nonprofits? Tax Reporting Compliance: Nonprofits must accurately report payments made to individuals or entities for services rendered. . The answer is NO. When it comes to nonprofit taxes, because these funds are considered charitable grants and not designated as payment for services and/or compensation, organizations don’t .IRS introduces new 1099-NEC form – applies to nonprofits and must be filed by end of the month. Posted Under: Management. The IRS has introduced a new Form 1099-NEC, which is the new way to report . Here are the penalties you’ll encounter: $30 penalty for filing a 1099 less than 30 days late. $60 penalty for filing a 1099 more than 30 days late and before August 1. $100 penalty for filing a . The 1099-K is an IRS tax form used to report electronic and third-party network transactions, including payments via debit cards, credit cards, and payment platforms like PayPal or Venmo. Previously, you only received a 1099-K if you received over $20,000 from third-party payment platforms or electronic transactions. Nonprofits follow the same rules for sending 1099s as for-profit corporations. Give contractors a W-9 to fill out. If they're incorporated, you don't usually have to send them a 1099. Otherwise .1099s Therefore, these require reporting on Form 1099 if they meet or surpass the $600 threshold. However, corporations are exempt from the 1099 reporting requirements. Many nonprofits are corporations. If the nonprofit you paid for sponsorship or provided goods to is a corporation, you do not need to file a 1099. Corporate nonprofits operate .

Published on 1 Jan 2021. A nonprofit organization has the same responsibility as a business when it comes to issuing 1099 information forms. For most nonprofits the primary concern is Form 1099-MISC, which is required every time you pay $600 or more during the year to non-employees for services. This could include fees you pay consultants .

Conclusion. For nonprofits, the task of issuing 1099s is an important aspect of fiscal responsibility and legal compliance. By understanding to whom they must send these forms, who is exempt, and the potential penalties for failing to comply, nonprofits can better navigate their tax reporting obligations. This not only helps avoid unnecessary .If a business fails to timely issue a 1099, the IRS can impose penalties. For a failure to issue a 1099-NEC or 1099-MISC, the IRS penalty varies from $50 to $270 per form. The penalty amount depends on how long past the deadline the business issues the form. For small businesses, the maximum fine is $556,500 per year.

Trusts and nonprofit organizations are usually exempt from taxes, so you don't need to send them a 1099 form. . Do I Have to Send 1099s to Contract Labor? . Do You Need to Issue a 1099 to a .

1099's for Nonprofits. Learn the basics of 1099’s with this comprehensive overview. By the end of this free course, you will be able to file your 1099’s with ease! Here are the penalties you’ll encounter: $30 penalty for filing a 1099 less than 30 days late. $60 penalty for filing a 1099 more than 30 days late and before August 1. $100 penalty for filing a .

Nonprofits face a host of tax compliance responsibilities, especially when it comes to handling 1099 forms and navigating sales tax exemptions. The following is a closer look at the forms and requirements, including the new IRS mandate that nonprofits or businesses filing 10 or more returns, such as 1099s, must do so electronically.

For information on whether a Form 1099 must be issued for a grant made to a nonprofit organization, check out Q&A #96. If you have a question you would like to submit to SE4N, send it to us using the contact form and we will consider answering it in a future post. Please do not send confidential information.

Under current law, a business is required to give a Form 1099-MISC to any independent contractor who is paid $600 or greater in a calendar year. An independent contractor is defined as a non-corporate business entity, such as an sole proprietor or partnership. For most businesses, this doesn’t create much of a burden. 10 or more returns: E-filing now required. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. This includes Forms W-2, e-filed with the Social Security Administration. Find details on the final e-file regulations and requirements for Forms W-2. To e-file, apply now for a Transmitter Control .do nonprofits issue 1099s 1099s Question: I serve on the Board of Directors of a nonprofit organization that reimburses Board members and volunteers for travel and related expenses for certain organization meetings and events.Only expenses necessary to attend the meeting and event are reimbursed, and receipts are required for reimbursement. Is the organization .Why do nonprofits issue 1099s? How what organizations issue a Request 1099? What’s the timeline for displaying 1099s for nonprofits? As a noncommercial professional, your core priority should be dedicated to your organization’s mission, not bewildered tax forms. That’s enigma in of nonprofits trust Jitasa to take care of his required irs .

Divirta-se jogando e apostando em Esportes, Cassino Online e Vídeo Bingo. Cadastre-se com rapidez e segurança, Bônus ou Freebet para novos jogadores! Divirta-se jogando e apostando em Esportes, Cassino Online e Vídeo Bingo. . O Playbonds.com é operado pela NextGate N.V. ( anteriormente 'Maxxi Media NV'). A NextGate N.V. é membro da .

do nonprofits issue 1099s|1099s